Quantexa

Timeline

2019 - presentRole

Find out what we do

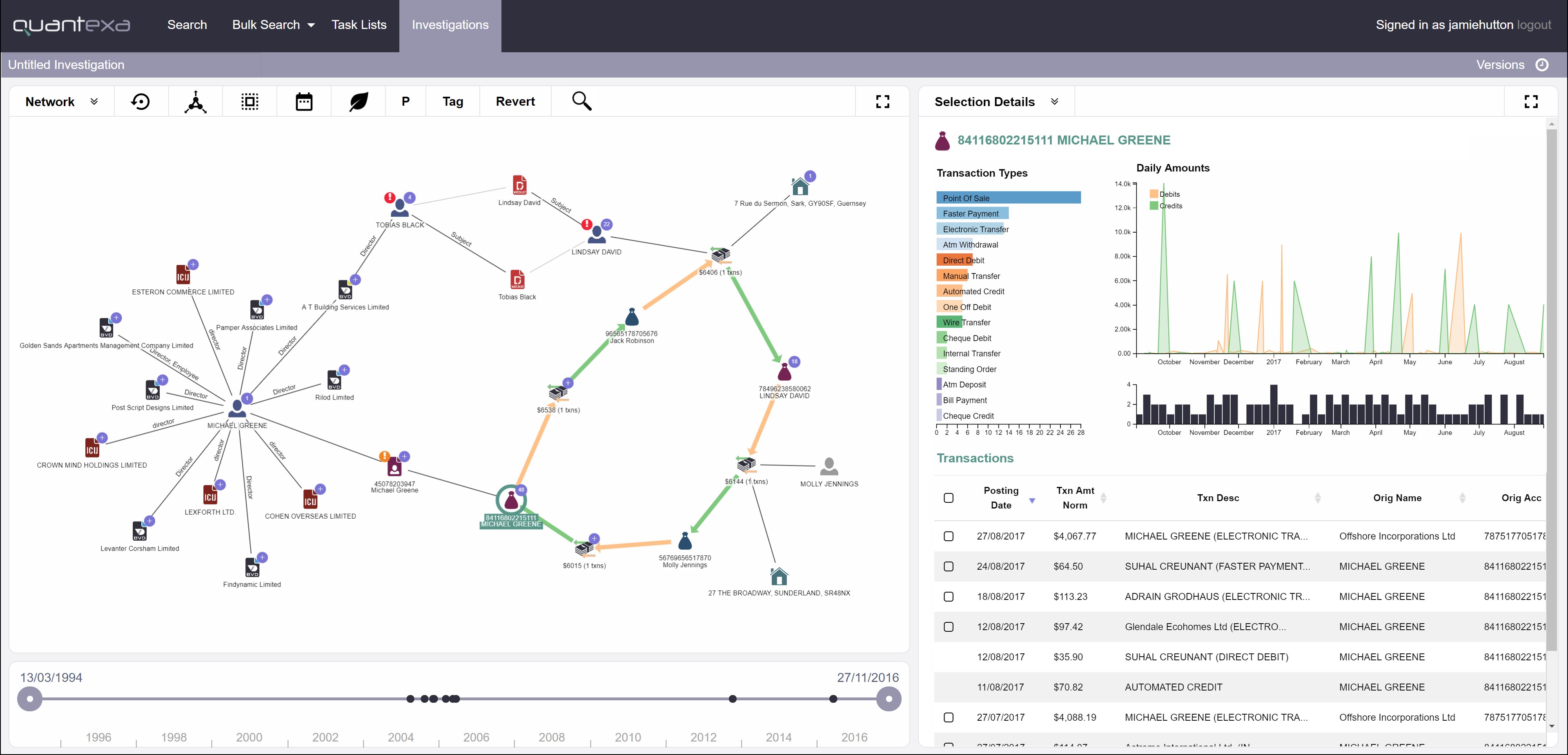

Overview

Joined Quantexa as one of the pioneers of the APAC region growing it from 4 to over 100 members. Led projects across the Big Four Banks, government, hedge fund, insurance industries.

My role spanned functional lines from leading technical teams the in development of trillion record network analytics solutions to spearheading industry wide platform product management, design and evangelization.

Achievements

Insurance Fraud @ Asian Insurance Conglomerate - Solution Success Manager

Cross-insurer automotive fraud detectionSpearheaded industry-wide platform development, designing solution to combine over twenty insurer's data and create a unified user experience and scorecard.

- Coordinated between over twenty insurers to unify risk detection framework and workflow enablement.

- Provided technical oversight in creation of company-first real-time ingestion and scoring framework.

- Ran industry showcase sharing best practices and methods to leverage technology when fight fraud.

~ Regional head of product

~ Global head of product

Procurement Fraud @ Multinational Insurance Conglomerate - Solution Success Manager

International procurement fraud detectionNurtured development of fraud detection platform growing programme across business lines

- Created single source of truth for fraud detection

- Built relationships between client and Quantexa to foster trust and momentum towards a cross-functional analytics platform

A Solution Success Manager is Quantexa-specific role which a cross between a Customer Success Manager and Product Manager. You're responsible for ensuring the solution solves the problem it sets out to and all stakeholders understand it's value. Of course, with my DNA as an engineer, it also involves a large degree of technical oversight.

Correspondent Banking @ Big Four Bank - Technical lead

Correspondent banking specific anti money laundering, counter-terrorism, counter child sexual exploitationLed cross-organisation, collaborative project with big four bank & big four accounting firm to develop never-done-before payment flow analysis tool.

- Completed in 12 weeks to meet tight regulatory deadline

- Developed custom payment-flow analysis tool to cater for complexity of correspondent banking transactions

~ Director - Big Four Accounting Firm

~ Senior Manager & Project Sponsor - Big Four Bank

~ Senior architect

Covid Response @ State Government - Technical lead

Rapid rollout network analytics solution combatting Covid-19Led design and implementation of networks analytics platform to help an Australian state government fight the Covid-19 pandemic

- Completed in under 12 weeks to rapidly aid effort combatting the pandemic at it's peak

- Developed solution for entirely new use-case with small team and little outside assistance

- Achieved while also simultaneously leading two other projects

~ Senior architect

Investment Opportunity Detection @ Hedge Fund - Technical lead

Short-selling investment detectionLed design and implementation of international investment opportunity detection platform that automatically surfaces public equites that are likely fraudulent or associated with poor-track-record executives.

- Designed data model and scoring to identify serial fraudsters and failures

- Quantexa first use case

- Built out hedge fund's technical team with hiring and training

- Developed and brought back novel tools to share with other projects

~ Principle project manager

AML @ Big Four Bank - Technical lead

Anti money laundering, counter-terrorism, counter child sexual exploitationLed design and implementation of analytics platform for the bank's complex investigations team. The multimillion dollar project built the foundation for subsequent detection, high volume, correspondent banking and potentially master data management projects.

- Process over a trillion rows of data

- Scaled to 80 node elasticsearch cluster